Building Your Financial Fortress in 2025

The new year is nearly upon us, and boy, is the financial landscape changing at warp speed. At Well and Wealthy, things are looking… different, with a capital “D.” We’re witnessing a level of change that screams for a reboot in how we do financial planning.

So, what’s the 2025 forecast? Challenges and opportunities—yes, both are coming in hot for your wealth-building journey and future financial security. This guide? It’s here to arm you with the strategies and insights needed to construct your own financial fortress amid these roller-coaster times. Buckle up.

What’s Shaping the 2025 Economy?

Inflation and Interest Rates

Buckle up, folks – the 2025 economic scene is a rollercoaster of challenges and opportunities. Global uncertainty keeps our financial planners on their toes. Goldman Sachs Research forecasts that core PCE inflation, sans tariff doodads, will dip to 2.1% by the year’s end. Yeah, lower than those dizzying peaks of yesteryears, but still throwing a wrench in budgeting and spending. The Fed’s got its hands on the monetary policy dial – tightening it up has kept a lid on inflation but cranked interest rates northward. Higher rates mean your mortgage and credit card frostings just got thicker – forcing a serious rethink of financial game plans.

Global Events and Market Volatility

World events – the usual suspects – are stirring up the financial brew. Geopolitical skirmishes, trade spats, and the never-ending post-pandemic recovery dance make the market a jittery mess. Enter the MOVE index – our trusty volatility barometer for the treasury market – flickering like a faulty bulb. This seesaw of volatility sends liquidity on holiday thanks to steeper collateral haircuts – tweaking investment playbooks and shaking market stability.

Tech-Driven Financial Shifts

Hold onto your digital hats as cryptocurrencies and blockchain wave their wands over the financial sector. Central banks are either flirting with or getting hitched to digital currencies – flipping the script on transactions and savings. And the fintech revolution? It’s breaking down the velvet ropes of investing – user-friendly apps putting trading floors into our pockets, democratizing market access like never before.

Emerging Markets and Sustainable Investing

Eyes on Asia and Africa – emerging markets are the new investment frontier. High growth potential (but crank up the risk thermostat), they say. Meanwhile, Environmental, Social, and Governance (ESG) investing – not just for tree-hugging tycoons anymore. Global ESG assets hit a whopping $30 trillion in 2022 and are set to burst through $40 trillion by 2030. Sustainability is no longer a buzzword – it’s a mainstay in shaping long-term financial performance.

Adapting to the New Economic Reality

In this whirlwind of change, staying informed and agile is your best bet. Regular check-ups on your financial GPS and a flavor-packed diversification strategy can steer you through the maze of 2025’s economic dance. As we charge forward, savvy investment playbooks will be your shield against the ever-shifting economic tides.

How to Invest Smartly in 2025’s Volatile Market

Diversification: Your Shield Against Volatility

Ah, 2025 – the investment landscape is a veritable minefield of risks and opportunities. Navigating this financial jungle requires a strategy that’s as fluid as the market itself. Enter diversification. It’s not just a “nice to have” – it’s mission-critical. Picture it as your armor, spreading bets across different asset classes, sectors, and even time zones. It’s all about risk mitigation, baby, and maybe a little return boost on the side.

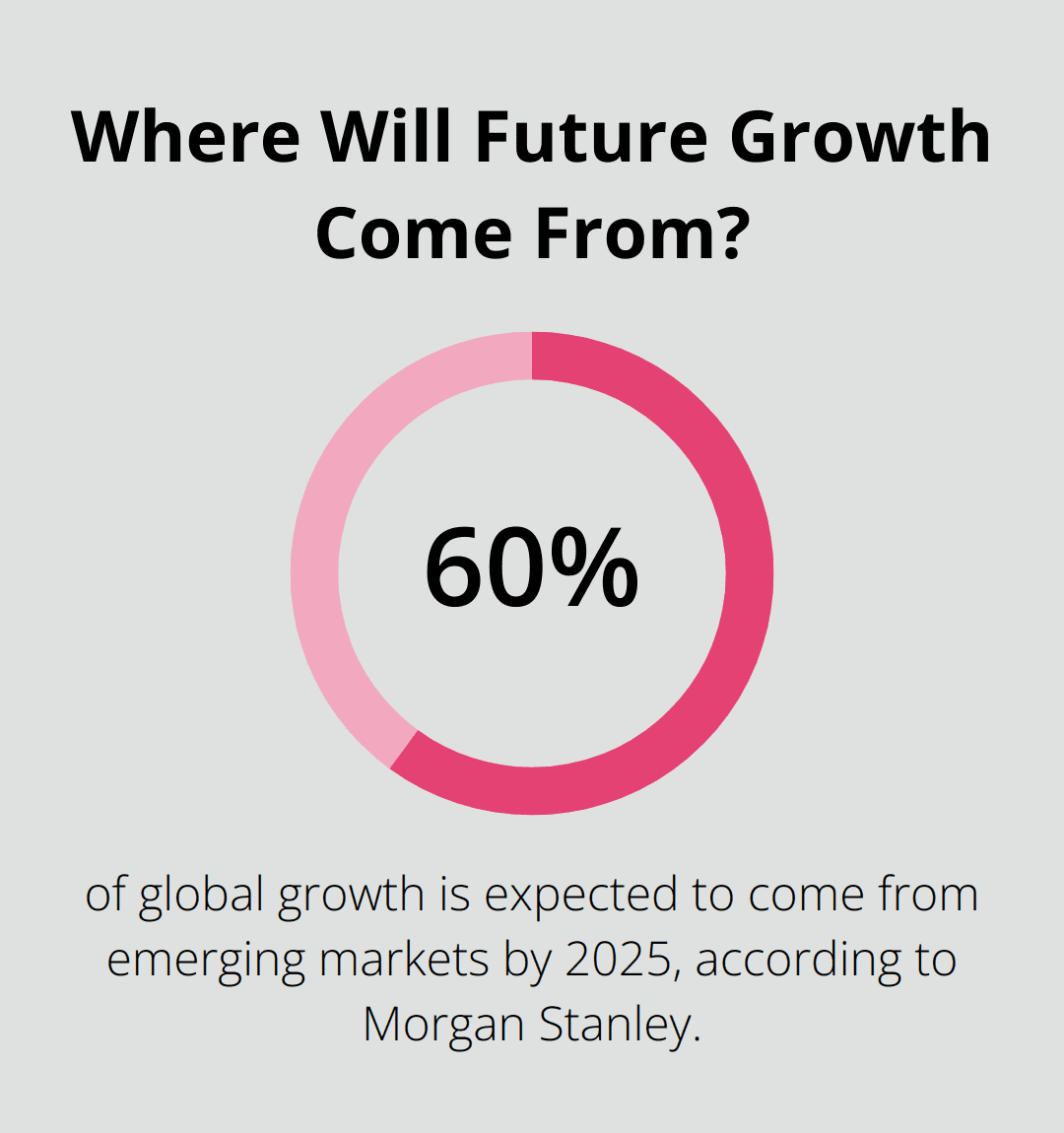

Now, let’s not forget the classics; throw some love to government bonds or those rock-solid blue-chip stocks. They’re your financial airbags in a crash. But hey, don’t sleep on growth. Emerging markets – yes, they’re volatile, like a teenager with Wi-Fi issues – offer juicy potential returns. Morgan Stanley’s crystal ball sees more than 60% of global growth coming from these guys by 2025. Chew on that.

And how about a nod to real estate without the heavy lifting? Real Estate Investment Trusts (REITs) are your ticket. They’ve been showing off with an average annual return of 10.5% over the past 20 years (yeah, take that, S&P 500).

Leveraging Technology for Smarter Investing

Here’s the lowdown: the fintech revolution has blown the doors off traditional investing – and you’re gonna want to get in. Robo-advisors are your new BFFs, crafting diversified portfolios all dialed into your risk tolerance and financial goals. Bonus: they won’t clean out your wallet, with fees lounging around 0.25% to 0.50% of your account balance (traditional advisors better step it up).

Then we’ve got micro-investing apps – bite-sized investing. They let you drip-feed your money in, little by little, so you can build that wealth pile without breaking a sweat. They even make your coffee addiction work for you by rounding up purchases and turning spare change into investments. Money well spent, right?

For the control freaks who like to get their hands dirty, AI-powered stock screeners and predictive analytics tools are your secret weapons. They’re crunching zillions of data points to spot where the smart money might go next, helping you make decisions with a little less guesswork.

The Rise of Sustainable and Socially Responsible Investing

Sustainable investing – more than just a fad. It’s the backbone of savvy strategies now. Global ESG assets are on target to blast past $40 trillion by 2030, snagging over a third of total projected assets. It’s not just about warm fuzzies, folks – it’s about cold, hard returns. Morgan Stanley reports that U.S. sustainable equity funds outperformed the traditional gang by 4.3 percentage points median in 2020, with lower risk when things got rocky.

Want in? Think ESG-focused ETFs or mutual funds. They’re your gateway to companies with rock-solid environmental, social, and governance credentials. Or, if DIY’s more your style, use ESG ratings from big names like MSCI or Sustainalytics-evaluate the stocks yourself.

And let’s clear the air: sustainable investing isn’t just about dodging the “bad guys.” It’s about scouting out firms ready for tomorrow – be it through cutting-edge clean tech, ace labor practices, or top-notch governance.

Stay tuned, ’cause next we’ll dive into building financial resilience in these head-scratching times. We’ll share the lowdown on fortifying your financial defenses with an emergency fund, keeping debt in check, and putting in place rock-solid risk management practices to safeguard your financial stronghold.

How to Fortify Your Finances in 2025

Supercharge Your Emergency Fund

2025’s knocking, and let’s face it, financial resilience is not just smart-it’s essential. Economic uncertainties are like weather forecasts (you know, never reliable), and your financial future deserves more than a guess. So, let’s dive into some no-nonsense strategies to help you ride out any storm in style.

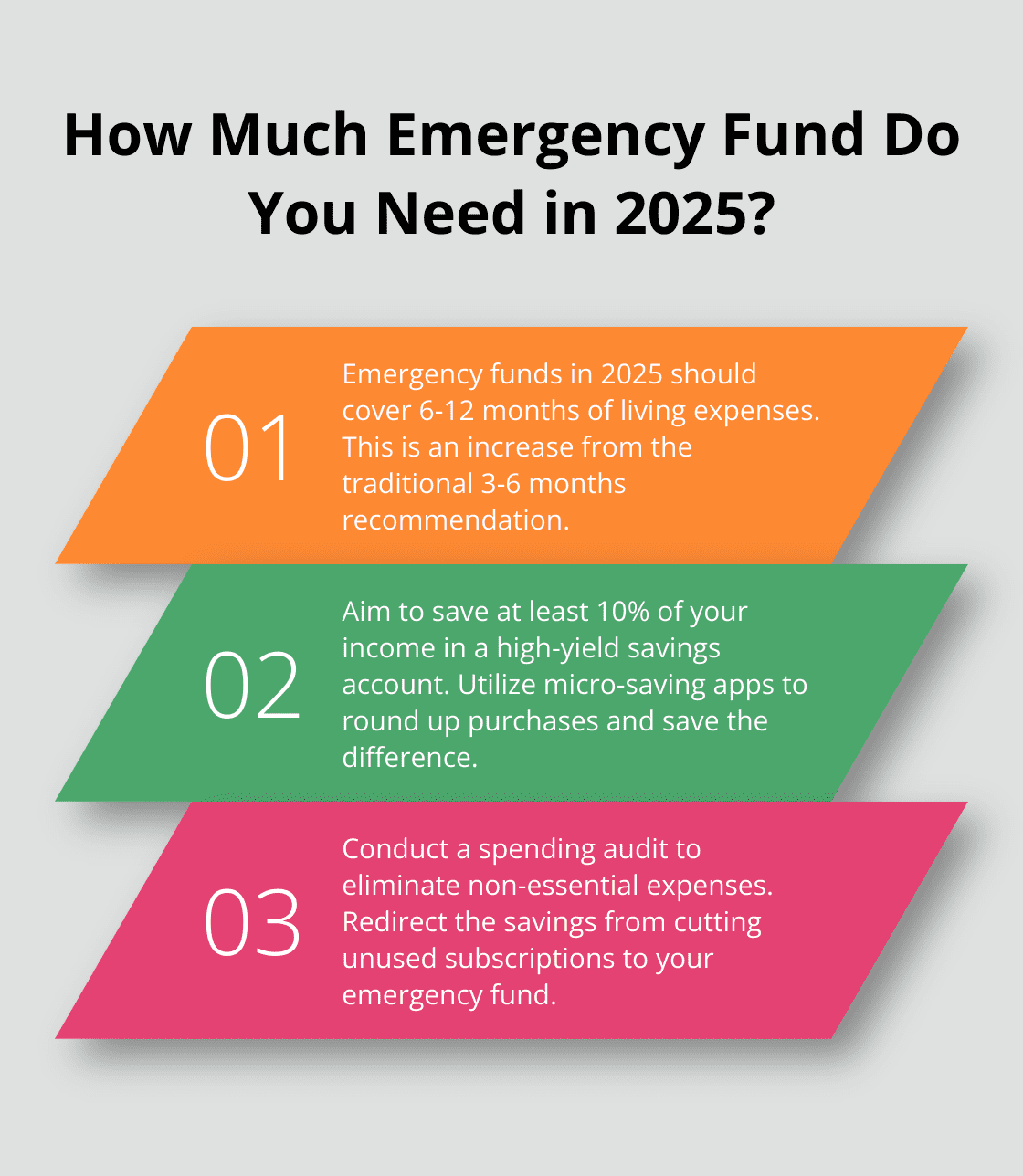

First on the agenda: your emergency fund. We’re not talking the old-school 3-6 months of living expenses-2025 demands 6-12 months, minimum. Why the jump? Because job markets flip faster than pancakes, and those out-of-the-blue expenses are the new normal.

Here’s your roadmap to a fortified fund:

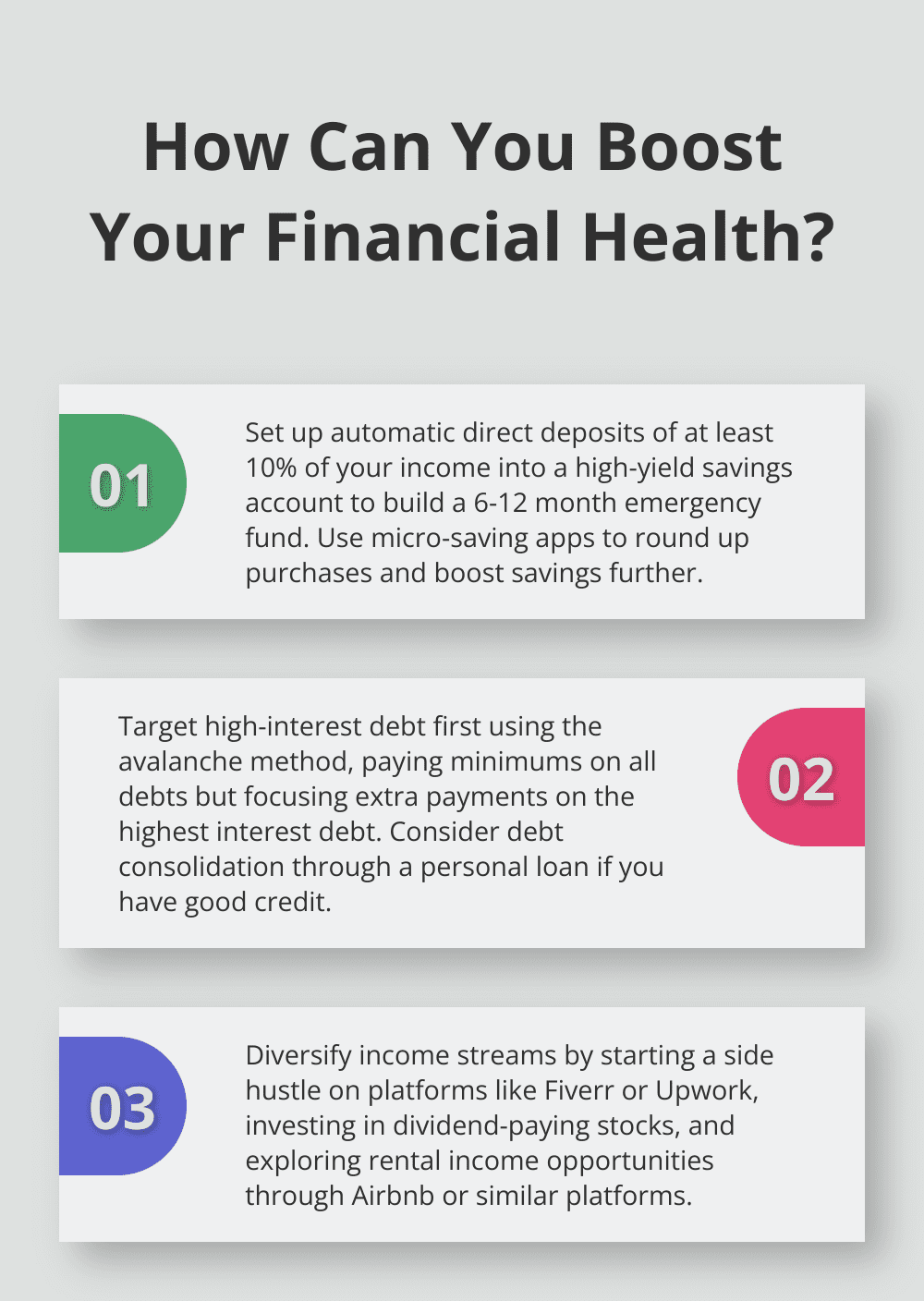

- Automate those savings. Set up a direct deposit from your paycheck to a high-yield savings account. Aim for at least 10% of that hard-earned income.

- Tap into micro-saving apps. They sneakily round up your purchases and save the difference. It’s like a ninja move for your savings-it just adds up, fast.

- Do a spending audit. Slice off the non-essentials and funnel that cash straight to your emergency fund. Trust me, you’ll be amazed at how much you can save just by axing those subscriptions you never use.

Tackle Debt Head-On

Interest rates are still playing hardball, and debt-yeah, it’s the silent thief. Here’s your game plan:

- Target high-interest debt like a heat-seeking missile. Think credit cards as the usual suspects. Go with the avalanche method: minimum payments on all, then unleash extra cash at the highest-interest debt first.

- Consider debt consolidation. Got a good credit score? You might snag a personal loan at a better rate than those plastic cards. This move can shave off hundreds in interest.

- Talk to creditors. Many are willing to knock down interest rates or whip up a payment plan if you make the first move. Don’t sit on the fence until you’re in the deep end-reach out early.

Bulletproof Your Income

In 2025’s gig economy, leaning on a single income stream is playing with fire. Here’s how to spread your bets:

- Start a side hustle. Leverage platforms like Fiverr or Upwork to cash in on your skills.

- Dive into dividend-paying stocks. They’re the gift that keeps on giving, providing a steady income stream even when markets take a nosedive.

- Explore rental income. Got spare space? Platforms like Airbnb can transform that idle room into a money-maker.

Upgrade Your Insurance Game

Let’s be real: insurance isn’t exactly thrilling, but it’s your financial safety net. In 2025, it’s high time for a review and upgrade:

- Health insurance: With medical costs shooting through the roof, a high-deductible plan paired with a Health Savings Account (HSA) is a savvy combo. HSAs bring triple tax benefits and can beef up your retirement savings.

- Disability insurance: It’s often overlooked but could be your saving grace if you’re unable to work. Seek coverage that replaces 60-70% of your income.

- Umbrella policy: As your assets stack up, so does your liability risk. An umbrella policy gives you a safety net beyond your home and auto insurance.

Building financial resilience isn’t about dodging risks-it’s about gearing up for them. These strategies will set you up to not only survive 2025’s economy but to thrive (and, hey, maybe even smile while doing it).

Final Thoughts

Building a robust financial fortress in 2025 – it’s not just about money, it’s about strategy… lots and lots of strategy. We’ve dived into economic trends, smart investment tactics, and how to bolster your financial defenses. What’s the magic word here? Adaptability. It’s the secret sauce in this ever-fluctuating financial landscape – making continuous learning and flexibility in financial planning not just useful, but essential.

Feeling overwhelmed? Totally normal. But remember, each move you make is like adding another sturdy brick to your financial stronghold. And the payoff? Peace of mind and a solid grip on freedom – the financial kind. Here at Well and Wealthy, we get it – your finances and your mental wellness? They’re inextricably linked, like peanut butter and jelly.

Enter The Self Improvement Journal – your guide to getting your life in order while keeping an eye on mental health. So, how about it? Take the plunge today: assess where you stand, crystallize those goals, and start implementing these strategies for a 2025 that spells prosperity.